Key Takeaways

- Mortgage offer validity typically ranges from three to six months, varying by lender and individual circumstances.

- Delays in construction or conveyancing can lead to your mortgage offer expiring before the property purchase is completed.

- Requesting an extension involves contacting your lender early, providing updated financial information, and formally submitting your request.

- Working with a mortgage broker and closely monitoring your application progress can help minimise the risk of offer expiration.

- If unable to secure an extension, you may need to reapply for a new mortgage or explore alternative financing options.

What Happens If My Mortgage Offer Expires Before Completion?

Navigating the path to your new home is exciting, and receiving a mortgage offer is a major milestone. However, it’s crucial to be aware that most mortgage offers expire within 36 months. If you don’t finalize your purchase by this date, your offer could become invalid, potentially delaying your move and incurring additional costs.

Unexpected delays in construction, conveyancing, or the completion process can threaten the validity of your mortgage offer. But don’t worry—you’re not without options. Your mortgage adviser can often refresh your offer without much hassle, or you might request an extension to keep your dream home within reach. Understanding these steps can help you stay on track and secure your new property with confidence.

How long does a mortgage offer last?

Most mortgage offers remain valid for three to six months, varying by lender and individual circumstances. The exact duration depends on factors such as the mortgage amount, property type, and current market conditions.

| Lender Type |

Offer Validity Period |

| Standard Lenders |

3 to 6 months |

| High-Value Mortgages |

Up to 36 months |

| Specialized Lenders |

Varies based on criteria |

During this period, complete the property purchase process, including surveys and conveyancing. Delays in construction or legal procedures can cause your offer to expire. If needed, contact your mortgage adviser or lender to extend the offer, ensuring you maintain the financing needed to secure your new home.

Why might a mortgage offer expire?

Mortgage offers have a limited validity period. Various factors can lead to their expiration before the property purchase is completed.

You reserved a new build early

Reserving a new build early can secure your preferred property and potential incentives. However, construction delays due to supply chain issues or staff shortages might extend the completion date beyond your mortgage offer’s validity. Typically, six months suffices for new builds, but delays may require requesting an extension from your lender.

The weather

Adverse weather conditions can impact the construction timeline and property completion. Severe storms, heavy rains, or extreme temperatures may cause work stoppages, delaying the completion date. Such delays can push the mortgage offer beyond its expiry, necessitating a renewal or extension to maintain its validity.

Mistakes on your mortgage application

Errors in your mortgage application, like typos or missing information, can slow down the approval process. Inaccurate details may require additional verification, extending the process beyond the offer’s expiry. Ensuring your application is complete and accurate helps prevent such delays and maintains your offer’s validity.

Delays in the conveyancing process

The conveyancing process involves legal work, including property searches and documentation. Issues such as incomplete searches or legal disputes can delay completion. These delays can extend beyond the mortgage offer period, potentially causing the offer to expire if not addressed promptly.

Your lender doesn’t arrange a valuation in good time

Lenders require a property valuation to confirm its value before finalizing the mortgage. If your lender delays scheduling the valuation, the approval process slows down. Valuation backlogs or scheduling conflicts can push the completion date beyond your offer’s expiry, risking its validity.

Can I get a mortgage offer extension?

Yes, you can extend your mortgage offer, although lenders are not required to approve it. To request an extension:

- Contact your lender early: Reach out 2–3 weeks before your offer expires to inform them of your need for more time.

- Provide updated information: Submit recent bank statements, proof of income, and any other documents the lender requires to verify your financial stability.

- Request the extension in writing: Follow your lender’s specific procedures to formalize the extension request.

Lenders may require a new property valuation or additional credit checks to ensure your financial circumstances remain unchanged. If your extension request is denied, consider the following options:

- Reapply for a new mortgage offer: This involves submitting a fresh application and may incur additional fees.

- Seek a different lender: Compare rates and terms from multiple lenders to find a suitable alternative.

- Negotiate with the seller: Adjust the completion date or request compensation for any delays caused by the extension.

Proactively communicating with your lender and providing all necessary documentation promptly can increase the likelihood of securing an extension.

How long can I extend my mortgage offer?

Most lenders permit mortgage offer extensions for a minimum of one month, with some allowing extensions up to six months based on their policies and your circumstances.

Typical Extension Durations by Lender

| Lender |

Extension Duration |

| Nationwide |

45 days for new build properties |

| Major Lenders |

Up to 6 months |

| Other Lenders |

Varies, typically 1-3 months |

Factors Influencing Extension Length

- Reason for Extension: Delays in conveyancing, property valuations, or construction can affect the extension period.

- Lender Policies: Each lender has specific guidelines and flexibility regarding extensions.

- Timely Communication: Requesting an extension promptly increases the likelihood of approval.

- Additional Requirements: Lenders may require updated financial information, a new property valuation, or credit checks.

Steps to Request an Extension

- Contact Your Lender Early: Reach out at least 2-3 weeks before your offer expires.

- Provide Necessary Documentation: Submit updates on your property purchase progress and reasons for the delay.

- Await Lender Review: The lender will assess your request based on their policies and your current financial situation.

Possible Outcomes

- Approved Extensions: Granted based on adequate justification and compliance with lender requirements.

- Denied Extensions: May require reapplying for a new mortgage offer or exploring alternative lenders.

By understanding these factors and acting promptly, you can effectively manage the extension of your mortgage offer to align with your property purchase timeline.

What could stop me from getting my mortgage offer extended?

Several factors may prevent your mortgage offer from being extended, including:

- Errors in Application: Mistakes or inconsistencies in your mortgage application can raise concerns, leading lenders to deny an extension.[1][2][4]

- Delayed Conveyancing: Prolonged conveyancing processes signal potential risks, resulting in an extension refusal.

- Negative Financial Changes: Significant changes in your income, employment status, or spending affect your eligibility, causing lenders to withhold an extension.

- Property Valuation Issues: If the property’s value decreases upon revaluation, lenders might refuse to extend the mortgage offer.

- Construction Delays for New Builds: Ongoing delays in construction lead lenders to reconsider extending their offer due to uncertainties in completion dates.

- Problems in the Property Chain: Complications within the property chain, such as delays from other buyers or sellers, impact your lender’s decision to extend the offer.

- Insufficient Notice: Requesting an extension without providing adequate notice, typically less than a few weeks, reduces the likelihood of approval.

- Incomplete Documentation: Failure to provide updated financial information, such as recent bank statements or payslips, prevents lenders from reassessing your eligibility for an extension.[1][2][4]

Addressing these potential issues proactively improves your chances of securing a mortgage offer extension.

How to minimise the risk of needing a mortgage offer extension

Work with a mortgage broker from the start

Collaborating with a mortgage broker streamlines the application process, reduces errors, and ensures effective communication with all parties involved. Brokers help find mortgage deals with suitable offer periods, minimizing the risk of expiry. They also coordinate with estate agents, solicitors, and building developers to keep your purchase on track.

Know when your mortgage offer expires

Always be aware of your mortgage offer’s expiration date. Most offers remain valid for three to six months, though high-value mortgages can last up to 36 months. Tracking this date helps you manage your timeline and take necessary actions to complete the purchase within the validity period.

Check the progress of your application

Regularly monitor the progress of your mortgage application and property purchase. For new builds or transactions within a property chain, delays can occur due to construction issues or other transactions. Staying informed allows you to address any obstacles promptly, reducing the likelihood of your offer expiring.

Tell your lender you need an extension early

If delays arise, inform your lender as soon as possible to request an extension. Provide updated financial information, such as bank statements and payslips from the past six months, to support your request. Early communication increases the chances of securing an extension, typically ranging from one to six months, depending on the lender’s policies and your circumstances.

What happens if I’m unable to get an extension?

If you can’t secure an extension for your mortgage offer, several consequences may arise:

- Offer Expiration: Your existing mortgage offer becomes invalid, preventing you from proceeding with the property purchase.

- Reapplying for a Mortgage: You’ll need to initiate a new mortgage application, which can take several weeks. This process involves submitting fresh financial documents and undergoing another credit assessment.

- Potential Higher Interest Rates: Market conditions may have changed since your initial application, possibly resulting in higher interest rates or less favourable terms.

- Increased Costs: Reapplying for a mortgage may incur additional fees, such as arrangement fees, valuation fees, or legal costs.

- Risk of Losing the Property: Without a valid mortgage offer, the seller may accept another buyer’s offer, causing you to lose the property you intended to purchase.

- Delay in Completion: Starting a new mortgage application can delay the completion date, affecting your moving plans and possibly incurring penalties for late completion.

- Negotiating with the Seller: You might need to negotiate a new completion date with the seller, which may not always be feasible, especially in a competitive market.

- Exploring Alternative Financing: If reapplying for a mortgage isn’t viable, you may need to consider alternative financing options, such as bridging loans, which can be more expensive and complex.

Addressing these issues promptly is crucial to minimise disruptions to your property purchase. Engaging with a mortgage adviser can help you navigate the process efficiently and explore available options to secure the necessary financing.

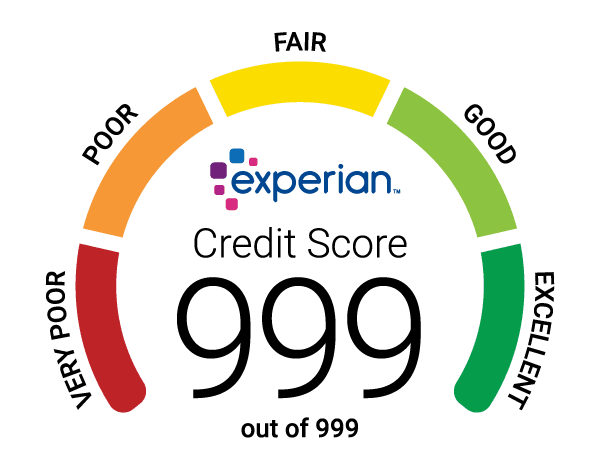

Will I be able to get another mortgage if my last one didn’t go through?

If your mortgage offer expires before completion, don’t panic. You can often reapply for a new offer, especially if your financial situation hasn’t changed. It’s crucial to act swiftly and reach out to your lender or mortgage adviser to discuss your options. They can help you understand the requirements and streamline the application process. Keeping your financial documents up to date and maintaining good credit will improve your chances of securing another mortgage. Staying proactive and informed ensures you remain on track to purchase your new home without unnecessary delays.

Frequently Asked Questions

How long is a typical mortgage offer valid?

Most mortgage offers are valid for three to six months, depending on the lender and your circumstances. High-value mortgages can last up to 36 months. The exact duration is influenced by factors such as the mortgage amount, property type, and current market conditions. It’s essential to complete the property purchase process within this period to avoid the offer expiring.

What can cause a mortgage offer to expire?

A mortgage offer might expire due to construction delays, mistakes in the application, delays in conveyancing, or issues with the property valuation. External factors like supply chain problems or adverse weather can also extend completion dates beyond the offer’s validity. Ensuring accuracy in your application and promptly addressing any delays can help maintain your mortgage offer’s validity.

Can you extend a mortgage offer?

Yes, you can request an extension for your mortgage offer. Contact your lender 2–3 weeks before the offer expires, provide updated financial information, and submit the request in writing. Lenders may require a new valuation or additional credit checks. While extensions are not guaranteed, proactive communication increases the likelihood of approval.

How long can a mortgage offer extension last?

Mortgage offer extensions typically last from one month up to six months, depending on the lender’s policies and your circumstances. For example, Nationwide offers 45-day extensions for new build properties, while major lenders may extend offers for up to six months. The duration depends on the reason for the extension and the lender’s requirements.

What should you do if your mortgage offer is about to expire?

If your mortgage offer is nearing expiration, promptly communicate with your lender to request an extension. Provide any necessary updated financial information and ensure all documentation is complete. Working with a mortgage adviser can also help navigate the process and explore alternative options if needed.

What are the consequences of an expired mortgage offer?

If a mortgage offer expires, you may need to reapply for a mortgage, which can take weeks and potentially result in higher interest rates or additional costs. There’s also a risk of losing the property if the seller accepts another offer. Additionally, delays in completion can disrupt your moving plans and overall property purchase timeline.

How can you prevent needing a mortgage offer extension?

To minimise the risk of needing an extension, work with a mortgage broker from the outset to streamline the application process. Stay aware of the offer’s expiration date, regularly check the progress of your purchase, and communicate early with your lender if delays arise. Ensuring all documentation is accurate and submitted promptly also helps maintain the offer’s validity.

What obstacles might prevent a mortgage offer extension?

Potential obstacles include errors in your application, delayed conveyancing, negative changes in your financial situation, property valuation issues, construction delays, complications in the property chain, insufficient notice when requesting an extension, and incomplete documentation. Addressing these issues proactively can improve your chances of successfully extending your mortgage offer.

Can you lose the property if your mortgage offer expires?

Yes, if your mortgage offer expires and you cannot secure an extension, the seller may accept another offer, leading to the loss of the property. Additionally, you may face financial setbacks from having to reapply for a mortgage or incur extra costs. It’s crucial to act promptly to prevent such outcomes.

What options are available if a mortgage offer extension is denied?

If an extension is denied, you can reapply for a new mortgage, seek a different lender, or negotiate with the seller to adjust the completion dates. Engaging with a mortgage adviser can help you explore alternative financing options and find the best solution to secure your new property.