Key Takeaways

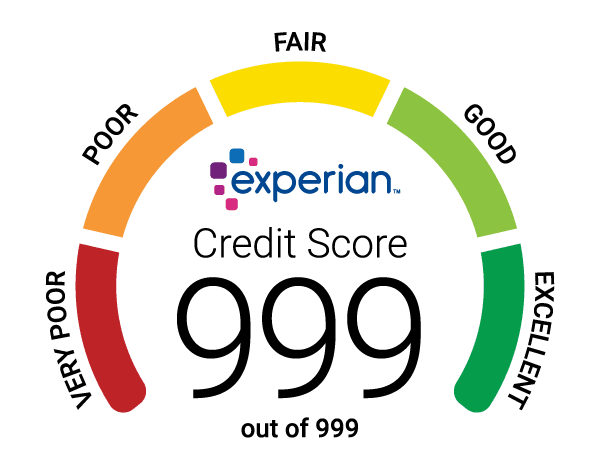

- Klarna now reports both on-time and missed payments to major UK credit reference agencies (Experian and TransUnion), making your BNPL activity visible on your credit file for purchases from 1 June 2022 onwards.

- Late or missed Klarna repayments can negatively impact your credit score and remain on your file for up to six years, potentially affecting your eligibility for loans, credit cards or mortgages.

- Klarna Pay in 3 and Pay in 30 Days use soft credit checks, which are not visible to lenders and do not affect your score unless you miss payments; Klarna Financing involves a hard credit check that appears on your file and may temporarily lower your score.

- Multiple active BNPL agreements can signal a higher credit risk to lenders, so limiting the number of open accounts is important for maintaining a healthy credit profile.

- Responsible, timely repayment is crucial when using any BNPL service to protect your credit standing and future borrowing potential.

- Regularly monitor your credit file to ensure Klarna repayments are recorded accurately and to promptly address any errors or negative marks.

Wondering if using Klarna’s Buy Now Pay Later services affects your credit file? You’re not alone. As BNPL options have become more popular across the UK, many shoppers want to know how these flexible payment plans might influence their creditworthiness.

With Klarna now reporting both on-time and missed payments to major credit reference agencies like Experian and TransUnion, your activity could start to shape your credit profile. Whether you’re splitting payments or delaying them, it’s important to understand how your choices might impact your ability to borrow in the future. Let’s take a closer look at what this means for you.

How does Buy now, pay later work?

Buy now, pay later (BNPL) lets you split purchase costs over time, creating flexibility at checkout for qualifying transactions. You get three common BNPL arrangements through Klarna:

- Pay in 30 days: Receive your item, then pay within 30 days. Payment processing happens automatically, often with the option to schedule ahead.

- Pay in 3 instalments: Spread your total, such as £120, into three equal interest-free payments of £40 each collected monthly.

- Financing: Convert your purchase into a longer-term loan, typically for six, 12, or up to 36 months. Pay interest based on your agreement, and check terms before proceeding.

BNPL approvals often factor in your credit score and past payment behaviour. Certain providers, including Klarna, may run a soft credit check before allowing you to use their short-term products. If you select a longer-term financing option, lenders generally conduct a more formal credit assessment.

BNPL services, when used responsibly, let you manage expenses without immediate interest charges. Payments made on time, late, or missed can appear on your credit file, depending on the product and reporting policy of the BNPL provider.

What are the main Buy now, pay later credit providers?

Several leading Buy Now, Pay Later (BNPL) credit providers operate across the UK retail and online market.

- Klarna: Klarna offers “Pay in 30,” “Pay in 3,” and longer-term financing. You can use Klarna for both online and in-store shopping at thousands of UK merchants.

- Clearpay (Afterpay): Clearpay splits payments into four interest-free instalments. You access Clearpay at many high street and e-commerce brands.

- Laybuy: Laybuy provides six weekly instalments, interest-free, across numerous UK retailers.

- PayPal Pay in 3: PayPal Pay in 3 allows you to split eligible purchases into three interest-free payments at checkouts where PayPal is accepted.

- Zip (formerly Quadpay): Zip breaks purchases into four instalments. Fewer UK merchants offer Zip compared to Klarna or Clearpay.

- Openpay: Openpay features longer-term, interest-free instalment plans, typically for higher-value purchases.

Other providers such as Affirm and Sezzle play a larger role internationally than in the UK market.

BNPL providers including Klarna and Clearpay now report customer information to major UK credit reference agencies. This makes your BNPL usage visible alongside other forms of credit, impacting credit assessment and lending decisions.

Does Buy now, pay later affect my credit score?

Buy now, pay later products affect your credit score based on your repayment behaviour and provider reporting. Klarna reports your BNPL payments to Experian and TransUnion, so responsible BNPL use—making payments on time—can help build a positive payment history and may benefit your credit profile. Missed or late payments get recorded as negative markers on your credit file and remain visible for up to six years, making it more difficult and costly to access future credit.

Multiple active BNPL agreements signal reliance on short-term credit, potentially increasing lender perception of risk when you apply for larger products, such as mortgages or loans. Hard credit checks occur with longer-term Klarna financing, influencing your score if payment issues arise. Short-term BNPL products, like Pay in 3 or Pay in 30, only involve soft checks and don’t appear directly on your credit record unless payments are missed or sent to a debt collection agency.

Negative marks from missed payments apply to all new Klarna purchases from 1 June 2022. Past purchases remain unreported. Other BNPL providers, such as Clearpay, do not usually report to credit reference agencies unless debts escalate to collections. Always review your records across Experian, TransUnion and Equifax, as reporting practices differ.

WARNING: Beware of missed payments damaging credit scores

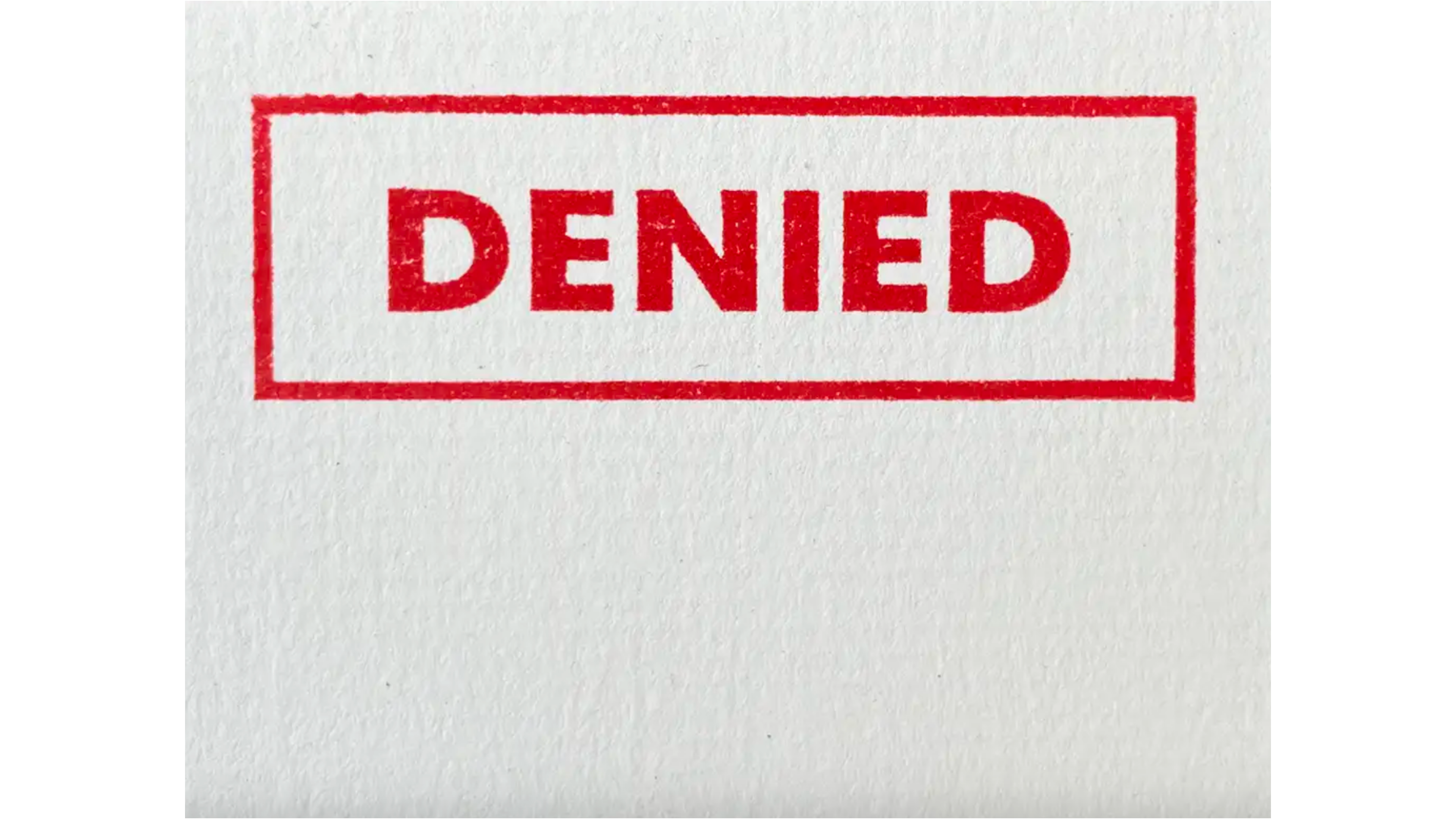

Missed or late payments on Klarna purchases display on your credit file with Experian and TransUnion, affecting your credit score immediately for new agreements since June 2022. Negative marks from missed repayments remain visible for up to six years, creating barriers when you apply for loans, mortgages or other credit products. Multiple missed payments or defaults may flag you as a higher risk to lenders, reducing your chances of future borrowing and sometimes making acceptance impossible.

Unpaid Klarna purchases, especially those unpaid beyond the agreed period, result in a default being recorded on your credit file. This default status signals immediate concern for other lenders and causes a substantial decrease in your credit score. Payment holidays and outstanding balances are also documented, so ongoing financial difficulties quickly become apparent in your file.

All aspects of your Klarna repayment history—on-time, late or unpaid—form part of the data used in lender affordability checks. Mortgage and credit providers often review these details to assess whether you’re able to manage new credit commitments. Repeated negative entries potentially signal financial strain, increasing the likelihood of rejections and higher interest rates if accepted.

| Impact Factor | Effect on Credit Score | Duration on Credit File |

|---|---|---|

| Missed payment | Damages score, reduces borrowing options | 6 years |

| Default on account | Severe damage, immediate decline by lenders | 6 years |

| Consistent late payment | Ongoing negative impact, risk signals | Up to 6 years per instance |

Does using Klarna affect your chances of getting a mortgage? And Clearpay and PayPal in 3?

Mortgage lenders in the UK consider your full credit file. Buy Now, Pay Later (BNPL) activity, including Klarna, Clearpay, and PayPal in 3, may influence your mortgage application if negative markers appear on your credit history. On-time repayments show responsible credit use, but missed or late payments can signal risk and reduce acceptance rates.

Klarna Pay In 3 – soft credit search

Klarna Pay in 3 uses a soft credit search for each application. This check appears on your credit report but isn’t visible to other lenders and won’t affect your credit score. Only missed or late payments are reported to Experian and TransUnion from June 2022 onwards. Lenders who review your file during a mortgage application won’t see the initial search, but they’ll see any missed payments, which can remain for up to six years and weaken your application.

Klarna Pay In 30 Days – soft credit search

Klarna Pay in 30 Days also performs a soft credit search at checkout. The check is visible only to you and doesn’t impact your score. Any late or missing payments are reported to major UK credit agencies and form part of your credit history. Mortgage lenders may view missed payments as negative, but on-time payments do not harm your file.

Klarna Financing – hard credit search

Klarna Financing involves a hard credit search, recorded on your file and fully visible to all lenders, including mortgage providers. Each hard search can temporarily lower your credit score, especially if several occur within a short timeframe. Any missed or late repayments are reported and carry significant weight in mortgage decisions. Lenders might see multiple hard searches or missed payments as signs of higher risk, leading to lower approval chances or stricter lending conditions.

| Service | Credit Check Type | Payment Reporting | Visibility to Mortgage Lenders |

|---|---|---|---|

| Klarna Pay in 3 | Soft | Yes, if missed | Missed payments visible, not search |

| Klarna Pay in 30 Days | Soft | Yes, if missed | Missed payments visible, not search |

| Klarna Financing | Hard | Yes | Check and payment data visible |

| Clearpay, PayPal in 3 | Soft | No, unless default | Only defaulted debt visible |

Will I be credit checked if I apply for Buy now pay later?

Applying for Buy Now Pay Later (BNPL) with Klarna leads to different types of credit checks, based on the product you select. Soft credit checks occur when you choose Klarna Pay in 30 Days or Pay in 3 instalments. These checks confirm your identity and review your financial history, yet they don’t affect your credit score or appear visible to other lenders.

Hard credit checks happen for Klarna Financing, which lets you spread payments over 6–36 months. These checks show on your credit file and other lenders can see them if you apply for further credit. Multiple hard searches in a short span may lower your eligibility for new credit.

BNPL providers, including Klarna, report your repayment behaviour for approved transactions made since June 2022 to Experian and TransUnion. Timely repayments reflect positively in future credit assessments, but missed or late payments remain on your credit file for six years and may negatively impact your score. If you’ve several active BNPL accounts, lenders might view this as a risk factor when assessing new credit or mortgage applications.

| Klarna Product | Credit Check Type | Appears on Credit File | Lender Visibility |

|---|---|---|---|

| Pay in 30 Days | Soft | Not on file | Not visible |

| Pay in 3 Instalments | Soft | Not on file | Not visible |

| Financing (6–36 months) | Hard | Yes | Visible |

Soft checks offer eligibility without affecting your credit standing, but hard checks and negative repayment behaviour stay on your record and influence future lending decisions.

Debt dangers of Buy now, pay later schemes

Using Buy Now Pay Later (BNPL) schemes like Klarna increases the risk of accumulating debt if you spend beyond your means. BNPL services make purchases accessible without immediate payment, but users often overcommit, leading to mounting balances and riskier financial positions during economic challenges. Missing or delaying BNPL repayments, including Klarna’s, results in negative marks on your credit file, reducing eligibility for mortgages, loans or credit cards.

BNPL platforms, including Klarna, report repayment behaviour to major UK credit reference agencies, so missed payments become visible to lenders and debt collectors. Recent figures show Klarna has faced significant credit losses as more users struggled with repayments. This pattern highlights how easy access to BNPL increases the risk of falling into debt traps, especially when managing multiple agreements.

Fees and debt collection pose further risks if you don’t manage Klarna repayments. Late fees and unpaid balances can escalate quickly, increasing the overall debt burden. BNPL providers have introduced hardship support and financial education, but these measures don’t fully address the risk of spending more than you can repay.

Klarna repayment details for new purchases from 1 June 2022 now appear on your credit file, making responsible use visible but also exposing irresponsible use to future lenders. Multiple BNPL commitments in your credit file may raise affordability concerns when assessed for significant lending, like mortgage applications.

| BNPL Dangers | Example | Impact |

|---|---|---|

| Overspending | Multiple fashion or tech purchases | Difficulty repaying, increased credit file risk |

| Missed repayments | Unpaid Klarna instalments | Negative credit mark, lower borrowing eligibility |

| Escalating debt through fees | Repeated late payments | Additional financial strain, collection actions possible |

| Lender visibility of BNPL use | Active Klarna/BNPL obligations | Reduced acceptance rates for loans or mortgages |

Multiple missed BNPL payments remain on your credit file for up to six years, so consistent on-time repayment is crucial to avoid long-term damage to your financial profile.

How to use Klarna, Clearpay and PayPal Pay in 3 safely

Using Klarna, Clearpay and PayPal Pay in 3 safely requires specific steps to protect your credit profile and avoid debt risks.

- Borrow within your means: Only use BNPL services for amounts you can repay easily, as excessive borrowing signals financial strain to lenders and increases debt risk. Two fifths of shoppers spend more when using BNPL[1], and over half say use of these schemes contributed to their personal debt levels.

- Pay on time consistently: Timely repayment for Klarna prevents negative markers on your credit file, which can remain for up to six years. Clearpay and PayPal Pay in 3 don’t report payment behaviour to UK credit agencies, but missed payments may prompt late fees and account restrictions, affecting continued access.

- Set payment reminders or automate payments: Automated payments through direct debit or scheduled reminders ensure payments reach providers on the due date, reducing risk of missed instalments and subsequent penalties.

- Monitor your credit file regularly: Checking your credit report highlights new BNPL entries from Klarna and ensures payment records for BNPL services appear correctly. Klarna reports to Experian and TransUnion, so prompt action identifies or addresses inaccuracies.

- Limit multiple BNPL arrangements: Opening several BNPL accounts simultaneously can indicate credit dependence to lenders. Even where providers don’t share data, visible debts or frequent searches may reduce creditworthiness for significant applications.

- Understand service differences: Klarna shares purchase and payment information with credit reference agencies, covering on-time and missed payments. Clearpay and PayPal Pay in 3 don’t perform credit checks or report to agencies, but all three may impose late fees or refer debts for collection if payments are consistently missed, which could then affect your credit record.

| Service | Credit Check Type | Reported to Credit Agencies | Impact of Missed Payment |

|---|---|---|---|

| Klarna (Pay in 3/30) | Soft check | Yes, Experian/TransUnion | Negative mark for 6 years possible |

| Klarna Card/Financing | Hard check | Yes, all agencies | Default increases debt collection risk |

| Clearpay | None | No | Late fees, possible account ban |

| PayPal Pay in 3 | None | No | Late fees, account restrictions |

Missing payments repeatedly can trigger debt collection activity, impose defaults, and block future use of BNPL schemes on your account. By borrowing only what you can afford, ensuring punctual payments, and monitoring your credit, you maintain healthy credit status and reduce potential debt.

Ways to protect your credit score

- Pay on time every month

Paying Klarna instalments by the due date keeps your credit file clear of negative markers and prevents six-year damage entries for late or missed payments.

- Limit the number of active BNPL accounts

Opening several Klarna or other BNPL agreements signals reliance on credit for everyday purchases, which lenders may see as a risk when making decisions.

- Check your credit file regularly

Checking your credit report with agencies such as Experian or TransUnion helps you spot errors early and see how Klarna accounts appear on your profile.

- Understand Klarna payment types

Soft credit checks for Pay in 3 or Pay in 30 Days leave no visible trace or credit score impact if all payments are made as agreed; hard checks with long-term Klarna Financing show on your credit file and can affect applications.

- Borrow only what you can repay

Borrowing less than your budget allows lets you meet every Klarna deadline and avoids negative entries from unpaid balances, defaults, or referrals to debt collectors.

- Monitor missed or late payments

Missing even one Klarna payment creates negative file markers visible to lenders for six years and may require up to 72 months of positive behaviour to rebuild scores (source: Experian, TransUnion).

| Action | Effect on Credit File | Source |

|---|---|---|

| Pay on time | Keeps file clear, no negative marker if all paid | Experian, Equifax, TransUnion |

| Late or missed Klarna payment | Negative marker recorded, remains for 6 years | Experian, Equifax, TransUnion |

| Multiple simultaneous BNPL agreements | Signals reliance on credit, may hamper future lending | Experian, Equifax, TransUnion |

| Hard credit check (Klarna Financing) | Visible to all lenders, may lower credit score temporarily | Klarna, TransUnion |

| Check credit report frequently | Enables prompt error correction, clear knowledge of Klarna entries | Experian, Equifax |

Consistent, responsible Klarna use keeps your credit score stable and supports your creditworthiness in lender assessments.

Frequently Asked Questions

Knowing how Klarna appears on your credit file puts you in control of your financial future. Staying informed about how your repayments are reported helps you make smarter decisions when using Buy Now Pay Later options.

If you manage your Klarna payments responsibly and keep track of your credit file, you’ll be better placed to maintain a healthy credit profile. Staying proactive with your finances can make all the difference when applying for major credit like a mortgage or loan.

Frequently Asked Questions

Does Klarna affect my credit score in the UK?

Yes, Klarna can affect your credit score. On-time payments may help build your credit profile, but missed or late payments can negatively impact your credit file for up to six years and may affect your ability to get loans or mortgages.

How does Klarna report my activity to credit reference agencies?

Klarna reports both on-time and missed payments to major UK credit reference agencies such as Experian and TransUnion. This information appears on your credit file and is visible to future lenders.

Will using Klarna make my credit score go up?

Regular on-time payments with Klarna can support your credit profile, but simply using Klarna does not automatically increase your score. Missed payments, however, will have a negative impact.

What types of credit checks does Klarna use?

Klarna uses soft credit checks for short-term products like Pay in 30 Days and Pay in 3, which do not impact your score. Longer-term Klarna Financing requires a hard credit check, which can temporarily lower your score and is visible to other lenders.

Do missed Klarna payments harm my credit rating?

Yes, missed or late payments are reported to credit agencies and can remain on your credit file for up to six years, reducing your credit score and potentially harming future borrowing prospects.

Can having several BNPL accounts like Klarna affect loan applications?

Yes, multiple active Buy Now Pay Later (BNPL) agreements may signal to lenders that you rely on short-term credit, which can lower your chances of securing larger loans or mortgages.

Does Clearpay show on a credit report?

Currently, Clearpay does not report to UK credit reference agencies. Your Clearpay activity won’t appear on your credit file, but it could change in the future as reporting practices evolve.

Does PayPal Pay in 3 appear on credit files?

No, PayPal Pay in 3 currently does not report payment information to credit reference agencies, so it won’t appear on your credit file. However, this could change if future reporting rules are updated.

How can I use Klarna safely without damaging my credit score?

Always pay on time, set up payment reminders or automate payments, borrow only what you can afford to repay, and limit the number of active BNPL agreements. Regularly check your credit file for accuracy.

How long do missed Klarna payments stay on my credit file?

Missed or late Klarna payments can stay on your credit report for up to six years. This can impact lending decisions long after the missed payment, so prompt repayment is crucial.

Can BNPL use impact my mortgage application?

Yes, lenders review your full credit file including Klarna and other BNPL usage. Persistent on-time payments show responsible credit use, but late or missed payments can raise red flags when applying for a mortgage.

What is the maximum credit limit for Klarna?

Klarna does not have a fixed maximum limit. Credit limits are determined by your financial history, credit file, and past payment behaviour with Klarna. Limits may increase with responsible usage.

Should I worry about using Klarna or similar BNPL services?

BNPL can be helpful if used responsibly, but overspending or multiple missed payments can lead to debt problems and harm your credit score. Always borrow within your means and keep track of repayment dates.

What are the dangers of using BNPL services like Klarna?

BNPL products can make it easy to overspend and accumulate debt. Missed payments lead to negative marks on your credit report, late fees, and possible difficulties in obtaining credit or mortgages in the future.

How can I check if Klarna or my BNPL usage appears on my credit file?

You can access your credit report from UK credit reference agencies like Experian and TransUnion to see if your BNPL usage, including Klarna payments, is listed and ensure your records are accurate.